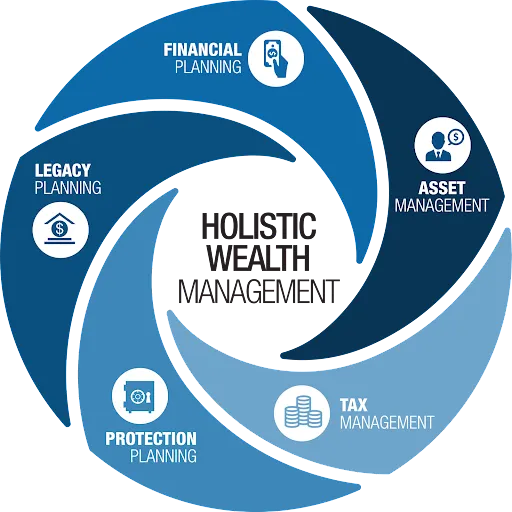

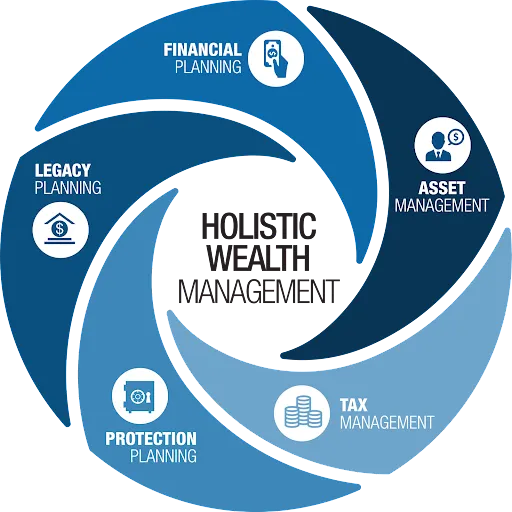

Five Pillars of Holistic Wealth Management

Financial Planning

This is the foundation of wealth

management. It involves assessing your current financial situation, setting goals, and creating a roadmap to achieve those goals. It considers various aspects like cash flow planning, savings and investing, as well as retirement income distribution planning. Our holistic planning process, The Bucket Plan®, involves a range of services aimed at helping you strategize and prioritize your goals for growing and protecting your wealth, as well as addressing other financial aspects of life along the way.

Asset Management

We recognize that managing significantly more assets requires an informed and disciplined approach. Our industry seasoned staff thoughtfully helps you construct a tax-efficient investment portfolio tailored to your risk tolerance, time horizon, and preferences. Our team analyzes different investment options, helps customize your portfolio, and regularly monitors and adjusts it to optimize returns while managing risks. In addition, we look beyond the traditional stock market to focus on helping you manage all the assets in your financial life, from real estate to private equity and everything in between.

Tax Management

It’s not about what you make, it’s about what you keep, and taxes can take a big bite out of your total wealth if left unmanaged. Our approach to taxes is three-fold: tax planning, tax management, and tax preparation. Tax planning is the blueprint to how we save you money on taxes. From there, the next step in building a proactive tax strategy is tax management by overseeing your taxes throughout the entire year to reduce your current and lifetime liability. Lastly, we design your tax plan to meet your needs and our team of CPAs and Enrolled Agents prepare your taxes, so you needn’t navigate complex tax law — our skilled professionals take care of it for you.

Protection Planning

Our approach involves assessing and mitigating risks that could affect your financial well-being. This includes having appropriate insurance coverage (such as life, health, long-term care, and disability) to protect against unforeseen events and potential financial losses. Protection planning also involves strategies to safeguard your wealth from potential risks, such as economic downturns, market volatility, or legal liabilities. This may include diversifying investments, setting up asset protection trusts, and employing risk management strategies.

Legacy Planning

Preserving your legacy and efficiently passing on your wealth to who you choose is a top priority, especially for those with considerable wealth. This involves organizing and managing your assets to ensure their efficient transfer to your beneficiaries after your death. We believe estate planning exists to answer three simple questions upon our passing: Where does our money go, who is in charge and what are the rules? Our team works with top estate planning attorneys to help create wills, trusts, and other documents to protect your assets, minimize taxes, and ensure your wishes are carried out.